Green Bay Packers, Declaration of Independence, Constitution … Sports Team Next?

Recently, the Green Bay Packers kicked off their sixth “stock sale” in the team’s history around the same time a small group of crypto fans launched a distributed autonomous organization (DAO) focused on the purchase of an early copy of the U.S. Constitution up for auction at Sotheby’s. Meanwhile, shares in 1776 broadside copy of the Declaration of Independence were available on Rally Road and another DAO (Krause House)is organizing to buy a small market NBA team. Innovations in fractional ownership and organizations with no central authority governed by members and built on the blockchain have enabled a new world, and the next few years are going to be wild.

I wanted to learn a bit more, so I jumped in to learn more about each of these models.

Green Bay Packers

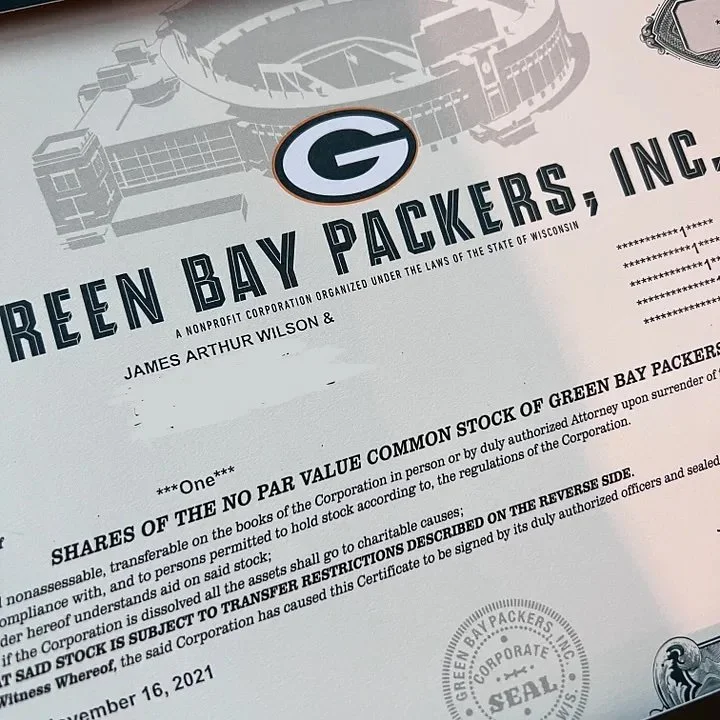

As someone born and raised in central Wisconsin, I was ready to join the “ownership” ranks of the Green Bay Packers. The Packers are unique in that they are the only non-profit, community-owned professional sports franchise in America. Recently, the Packers launched their sixth ever “stock” offering and I had a chance to finally become an “owner” in the organization.

Because the organization is a non-profit organization, it’s not stock in the typical sense — you can’t sell it or profit from it. There are some limited voting rights, access to special gear, and a process to pass shares to immediate relatives. Early sales kept the team viable, while the funds from recent sales are generally used for stadium improvements. Prior to this current offering, there were 361,400 share holders who collectively held 5,009,500 shares (with just two shareholders owning the maximum 200,000 shares).

Becoming a shareholder was a fairly straight forward process — filled out some information online, put in credit card details ($300/share, $35 processing fee, 200 shares max), and a few weeks later you receive your stock certificate. As of December 10th, the Packers had raised $54M on the sales of 165K shares with up to 300K shares authorized for sale by February 25, 2022.

This was likely the last stock sale that will happen with physical certificates (or at least only physical certificates). There is a strong likelihood that the next sale (perhaps several years away) will happen as a non-fungible token (NFT) project.

Declaration of Independence on Rally Road

Rally Road is a new platform that offers people the opportunity to have fractional ownership in mostly physical (some digital) collectibles like sports cards, wine, cars, and a rare copy of the Declaration of Independence. I purchased 5 shares at $25/share for partial ownership of the $2M document.

We’ve already received a buy out offer for the document at $2.8M, which represents a $31.46/share net price or 25.8% return. The ~5,400 shareholders voted against the purchase offer, which the “Advisory Board” turned down.

Many of these fractional ownership platforms (Rally Road, Masterworks.io for art, etc) are also rolling out secondary trading platforms that allow shareholders to buy and sell shares to one another after the initial offering, thus offering a bit more liquidity to participants.

One disappointment here is that, to the best of my knowledge, this copy of the Declaration of independence is not on display anywhere, but is being professionally stored and maintained. Masterworks.io, a company focused on fractional ownership of art, has a gallery at its New York City office where members can visit to see at least some of the art.

Constitution DAO

About the same time the green Bay Packers kicked off their sale, a distributed group of folks launched a DAO and started a movement to raise money and buy an original copy of the Constitution that was up for auction at Sotheby’s. Being largely a newbie to the crypto space, this was the most interesting but brought the largest learning curve.(Note: I am sure I’d display some ignorance below.)

Having only previously purchased bitcoin through Coinbase, I first had to set-up a wallet (I chose Coinbase Wallet). I then had to purchase some Ethereum (ETH), which I purchased 0.03113971 ETH for ~$147.46, plus an $11.17 transaction (“gas”) fee*, for a total of of ~$158.63. Then the craziest part, I made 0.001 ETH donation (~$4.21 at the time), with a transaction (“gas”) fee of 0.0167303 (~$70.44 at the time) to the cause. Outside of my small contribution, I was just an observer and no further participation in this DAO. For those following along at home, that was ~$85.82 to make a donation of ~$4.21 through a process that was far more complicated than any donation I have made before.

Overall, the DAO raised ~47M (~12K ETH) from ~17,400 donors, with a median donation size of ~$206. Unfortunately, the group was outbid by Ken Griffin, CEO of Citadel hedge fund.

Because my donation was so small, it didn’t make sense to take on more gas fees for the refund and I decided to instead claim my 1,000 PEOPLE tokens for a 0.007432 ETH (~$31.75 at the time). I was now ~$117.57 in for 1,000 PEOPLE tokens.

While it’s unclear exactly what utility PEOPLE tokens will bring (if any), as of 17 December they are trading at ~$0.14/ea, so my 1,000 PEOPLE is worth ~$140. Had the group won the bid, I would effectively have had 1,000 votes on the governance of the document — largely where it would get displayed and maintained.

In many ways this felt a lot like being a Green Bay Packer stock holder, and it got me wondering if anyone was already working on buying a professional sports team … which leads me to the final dabbling.

Krause House + WAGMI United

I was able to quickly identify two efforts focused on professional sportS: WAGMI United and Krause House. WAGMI (which is crypto slang for “we are gonna make it”) United is focused on purchasing an English soccer club (Bradford City specifically), while Krause House is generally focused on a small-market NBA team. Because I am more interested in basketball than soccer, I decided to focus on Krause House.

I have just started research on Krause House, and I plan to get more involved in the coming weeks to understand more about what it means to participate with a DAO. Krause House specifically organizes work around “seasons” and they look for people to contribute on marketing, business development, design, etc.

Because I have experienced the power of community/fan devotion growing up in Packer country, the hypothesis that an empowered (and possibly global) fan base resulting from fan ownership can really change the game for a small market NBA team. While i am not clear exactly how to best contribute, I’m sure I can find a way in the coming weeks and simultaneously build me knowledge on how this new format works. More to follow as I start this journey.

Takeaways

I’ve seen the power of DAOs to organize and move quickly, but it’s still very early for the infrastructure and tools needed to offer a great experience and that will inhibit mass adoption for the foreseeable future. The bar to create a crypto wallet, fund it, and join a Discord group is still too high for the average person, not to mention transaction costs are insanely high (at least on the Ethereum network). Consumer expectation is set by an Apple Pay or Shopify transaction today — which are as seamless as ever and retailers often cover the (much lower) transaction costs. Rally Road and buying Packers stock were much better and efficient processes.

While advocates push the security and transparency benefits of the infrastructure, the average person won’t care. Security is considered table stakes and while ledgers are public, most transactions are anonymous and it’s not clear yet that there is really transparency (i.e. are you getting bamboozled by a small group of insiders).

It is early, and it’s a great time to be a creator on the Internet.

Originally published 17 December 2021 on medium.com